ROAD TO HOME OWNERSHIP

Anyone can become a homeowner and so can you. We can make your dream of owning a home a reality. We're waiting to hear from you.

STUDENT LOANS

Stop letting student loan debt ruin your life. Call and see the many options you have regarding your student loans and take back control.

CREDIT REPAIR SCAMS

Know what to look for when choosing the right credit counseling service so you can avoid being scammed or taken advantage of. Get the facts!

WHY BANKRUPTCY

Bankruptcy is a viable option for many Americans looking for relief from excessive debt depending on their future financial goals. Find out if bankruptcy is right for you.

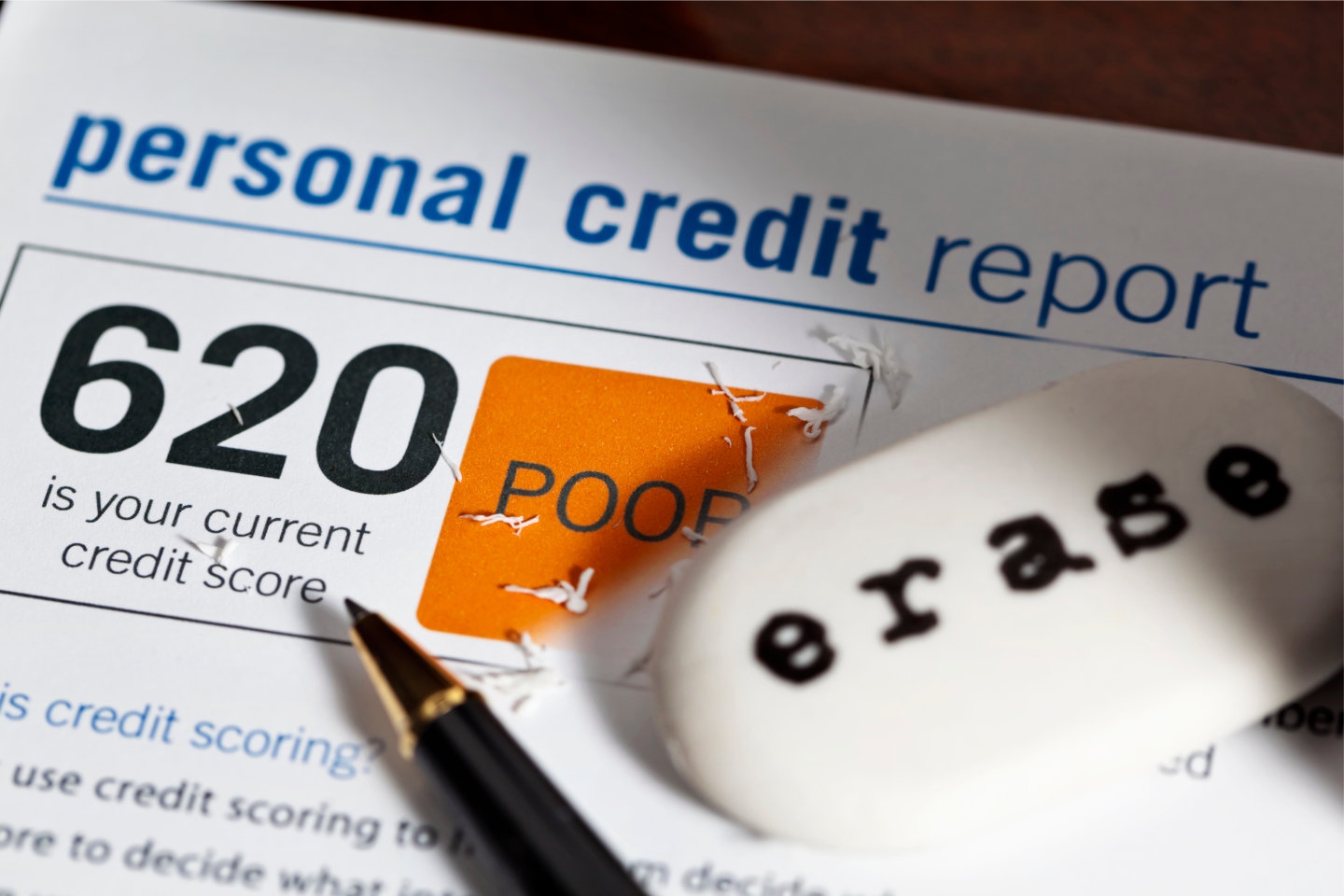

TRUTH ABOUT CREDIT

Your credit profile is the main key factor that will drastically increase or decrease your rate and ability to grow financially. Time to learn the facts about credit!

ELIMINATING YOUR DEBT

Don't take on the burden of managing your debt alone. Help is just a click away. We'll help you strategize a plan to better manage and or eliminate your debt.

IDENTITY THEFT

Remedying the effects of identity theft can be long, expensive and very exhausting. Learn how to protect yourself from this seriously growing crime.

THE MORTGAGE PROCESS

Learn what information is needed to obtain a mortgage and begin your preparation to become a future homeowner today!

FAQ's

Submit your questions to our community of consultants for answers and solutions to some of your most asked financial questions.