Credit is the very axis or hinge upon which our entire economy swings on. It is how lending decisions are made daily for the acquisition of certain goods and services. While some argue that it is impossible to realize personal character traits from a credit profile, or that it is unfair to reach certain decisions about an individual based on a three digit score, we must realize that a lot can indeed be gathered from viewing one’s personal credit report. At a close glance, a credit report not only reveals a person’s payment habits or whether or not they keep their word on fulfilling contractual obligations, but also whether or not they are an aggressive or conservative spender, if they are stable or move around frequently or even job hop from year to year, how they manage debt and other very important characteristics that are obvious when looking at a credit report.

For example, if a person has had a history of on time payments for the past 5 years on a particular debt or debts, then suddenly there are a string of late payments over a 6 month period, then they get back on track with timely payments over the next few years as revealed when looking at their credit report, there is usually a story that is associated with the 6 months where they got off track and a lot can be gained about that person's behavior or character. The 6 months of late payments are not typical behavior from this individual evidenced by the previous 5 years of on time payments as revealed by their credit report. From our many years of experience you can usually link the 6 months of late payments to a change in their lifestyle such as a layoff or job loss, payment decrease due to sick leave, divorce or something to that nature, etc. Conversely, when looking at one's credit profile that typically has never made consistent on time payments but are typically always late, a lot can be gathered about this person also, with the lack of understanding about credit and how it works being the top reason. So, it is highly conclusive that when looking closely at a credit profile, creditors can glean a great deal of information decide whether to extend an individual credit. Like it or not we live in a credit world, and regardless of our own individual opinions or feelings, it behooves us to educate ourselves so that we might come to understand this very thing that affects so many areas of our everyday lives.

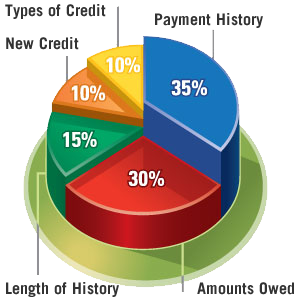

For example, if a person has had a history of on time payments for the past 5 years on a particular debt or debts, then suddenly there are a string of late payments over a 6 month period, then they get back on track with timely payments over the next few years as revealed when looking at their credit report, there is usually a story that is associated with the 6 months where they got off track and a lot can be gained about that person's behavior or character. The 6 months of late payments are not typical behavior from this individual evidenced by the previous 5 years of on time payments as revealed by their credit report. From our many years of experience you can usually link the 6 months of late payments to a change in their lifestyle such as a layoff or job loss, payment decrease due to sick leave, divorce or something to that nature, etc. Conversely, when looking at one's credit profile that typically has never made consistent on time payments but are typically always late, a lot can be gathered about this person also, with the lack of understanding about credit and how it works being the top reason. So, it is highly conclusive that when looking closely at a credit profile, creditors can glean a great deal of information decide whether to extend an individual credit. Like it or not we live in a credit world, and regardless of our own individual opinions or feelings, it behooves us to educate ourselves so that we might come to understand this very thing that affects so many areas of our everyday lives. The five things that make up your credit score are as follows, descending from the most to the least impactful:

Payment History - 35%

This is the biggest and single most important thing that has an impact on your credit score, and where it all starts. YOU MUST PAY YOUR BILLS ON TIME! A single late payment has the potential to lower your credit scores as much as 100 points or greater. This is a very key essential piece of your credit and must be made a priority when entering into an agreement to pay back a loan. It is important to note in understanding credit, that it is very much possible to pay every bill you’ve ever had on time and still have what would be considered marginal credit. You must realize again that paying your bills on time only accounts for 35% of your credit score but again is the most important piece and where it all starts. Almost 2/3 of the credit pie has absolutely nothing to do with paying your bills on time. Let’s look a little deeper!

Credit Limits - 30%

Maintaining proper credit limits is another gigantic piece of the credit pie. This is just as important as maintaining good payment habits and is almost equal in value. Just as a single late payment has the potential to decrease your credit scores as much as 100 points or greater as does high credit card balances. Let’s take a look at why. "Revolving" credit such as credit cards or certain lines of credit are referred to as "open ended” accounts because they have no end date for when the balance has to be paid in full. Once the account is paid in full the money can be utilized again and the payments start all over again. Unlike installment loans such as for a car, home and most personal loans, these types of loans are called "closed ended” accounts simply because they have an end date to which the balance must be paid in full.

It is important to note that a person’s ability to manage credit card debt, displays a different and very important characteristic and skill set. It displays debt management, conservativeness,

It is important to note that a person’s ability to manage credit card debt, displays a different and very important characteristic and skill set. It displays debt management, conservativeness,discipline and patience. Let's take a closer look at why this deserves to account for 30% of your credit score, and how revolving accounts reveal certain characteristics in an individual that installment loans cannot. A person that has a $10,000 credit card, with the potential and right to use the whole $10,000 at any given time yet doesn’t over let's say a 5-year period, displays a certain amount of judgment and discipline. In addition to his wise discretion, this same person never overextends himself, keeps his balances at 20% or lower at all times which displays great debt management, AND on top of all of that he pays it on time every month. This says a great deal about an individual, and whether they can be trusted with more. Revolving credit can reveal characteristics of aggressive or conservative risk taking, instability in one’s income or finances, or even whether someone is actually living off their credit cards which is not a wise thing to do, and so many other things. By looking at one's credit report and their revolving accounts, creditors can even tell "when" someone received their credit card and how "fast" it took them to max the credit card out. In this way your credit scores will be negatively impacted when your balances on these revolving accounts are too close to the credit limit.

For example, in this same example if this individual with the $10,000 credit card limit has $8000 charged to it, it will have a negative impact on his or her credit score because they have utilized 80% of their credit limit. When using credit cards, to achieve optimum scoring, you NEVER want to exceed 20% of your credit limit or a 20% "debt to credit limit ratio”. This will have a positive effect on your credit score. Give it a try! If your credit scores are not where you need them to be and you have credit cards that are maxed out, start paying down your credit cards to 20% balances and watch the impact it has on your score! This is one of the fastest ways to boost your credit scores. The way to figure out what you need to pay each credit card balance down to is done by using a simple formula. Simply take your credit card limit, using the same amount in this example of $10,000, and multiply by .2 ($10,000 x .2). This will give you $2000, which means that you never want to exceed $2000 worth of charges or 20% on a $10,000 credit card. You’re on your way… let’s look at the other 3 factors.

Length of History - 15%

This is another important factor in maintaining a healthy credit score. The longer your keep your accounts the better. This is typical and best displayed with open ended accounts again because installment or closed ended accounts have an end date and will inevitably come to a close, and it is good idea to pay them off early to avoid extra interest which is a wise thing to do. However, with open ended or revolving accounts it is best to keep using them over and over again so you can build up history which will help give you a more well-rounded mature credit profile. It is important to note that in reusing your credit cards that you do so on wise purchases that you can afford to pay off immediately. In this way you avoid paying interest on the purchase and it is a good indication that you can actually "afford" the purchase if you are able to pay it off immediately. It is also important to note that if you never use a credit card for anything that it will still report positive pay history to your credit report every month. The only risk you run there is the credit card company eventually closing the credit card because of non-use so occasional and wise use of your credit cards are recommended. In essence, it is not a good idea to close credit card accounts, as this will affect your debt to credit limit ratio and decrease your credit scores in most instances. Even if you don’t use them anymore and pay them off, it is a good idea to just let them sit, and never close them.

Account Types - 10%

Your credit profile needs to show versatility and diversity, or your ability to manage multiple accounts. It needs to be a good mix of revolving and installment accounts. When a lender looks at your profile and see that you have the ability to manage a car note, a mortgage payment, and credit cards without missing a beat, that says you can multitask and you are a very financially responsible individual, so mix it up a bit according to what your income will allow responsible borrowing.

New Credit - 10%

You must be very cautious about the number of times you allow lenders to view or pull your credit profile. This creates what is known as a hard credit inquiry which means that a lender has permission or permissible purpose to make a request to the credit bureaus to view your personal credit information. When done in excess these inquiries will decrease your credit scores so this must be done in wisdom and moderation. Watch those inquiries!

As you can see one must have some knowledge if they are going to become masters of their credit. While these tips are based solely on years of credit experience, the utilization of the information shared in this link will allow you to achieve your highest credit score ever. Though it may seem like too much information to digest at once, our consultants are always here waiting to help answer all your questions. Contact one today!